Space Exploration Technologies, commonly known as SpaceX, is a pioneering aerospace manufacturer and space transportation company founded by Elon Musk. With a mission to revolutionize space technology and enable human life on Mars, SpaceX offers a wide range of career opportunities for […]

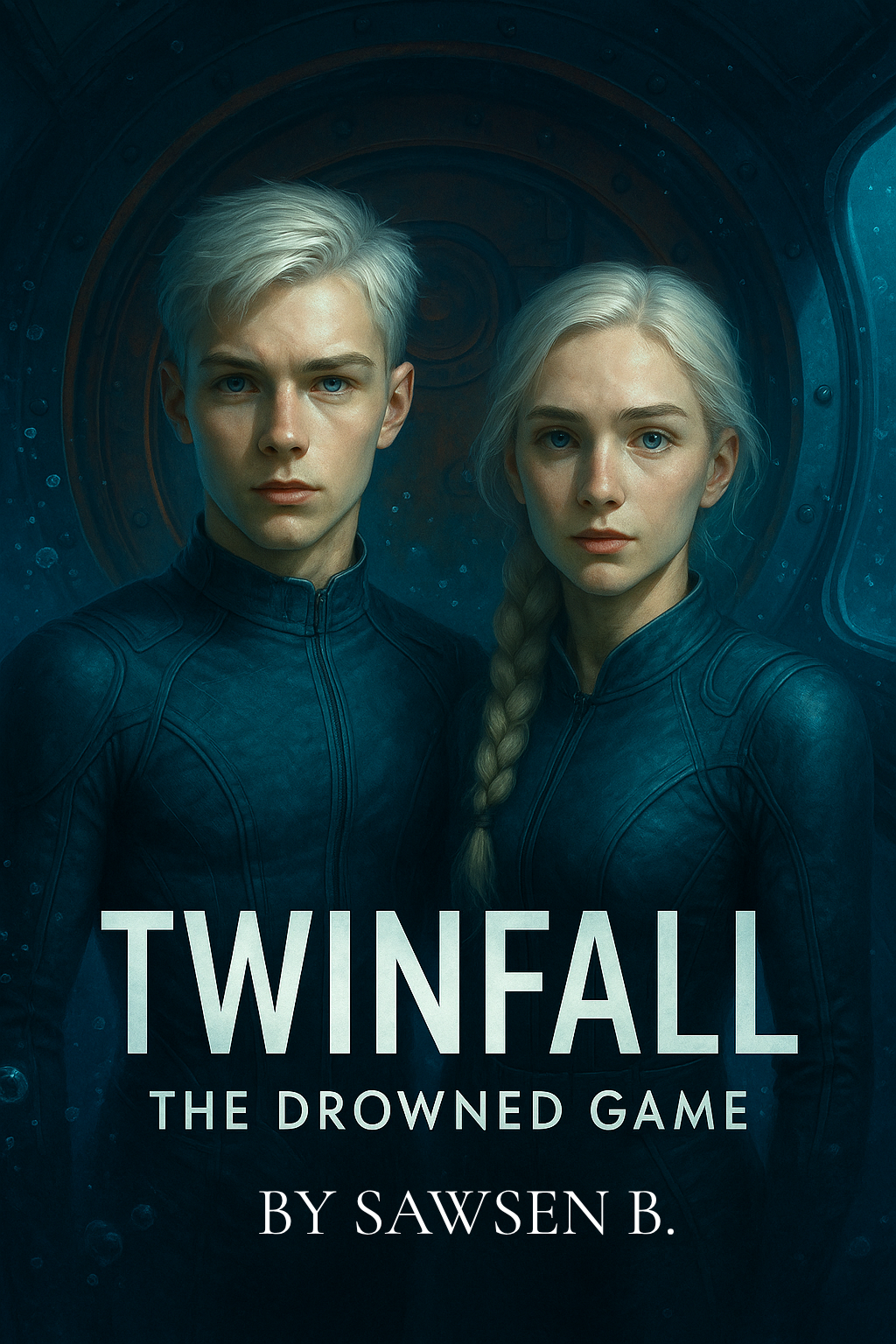

Space exploration games have captivated gamers for decades, offering the thrill of discovering uncharted planets, navigating asteroid fields, and encountering alien civilizations. With advancements in gaming technology, modern space games provide unparalleled exploration mechanics that make you feel like a true interstellar […]

Portfolio rebalancing is a critical process that ensures your investments stay aligned with your financial goals and risk tolerance. Over time, market fluctuations can cause your portfolio to drift from its target allocation, increasing risk or reducing returns. Portfolio rebalancing software simplifies this […]

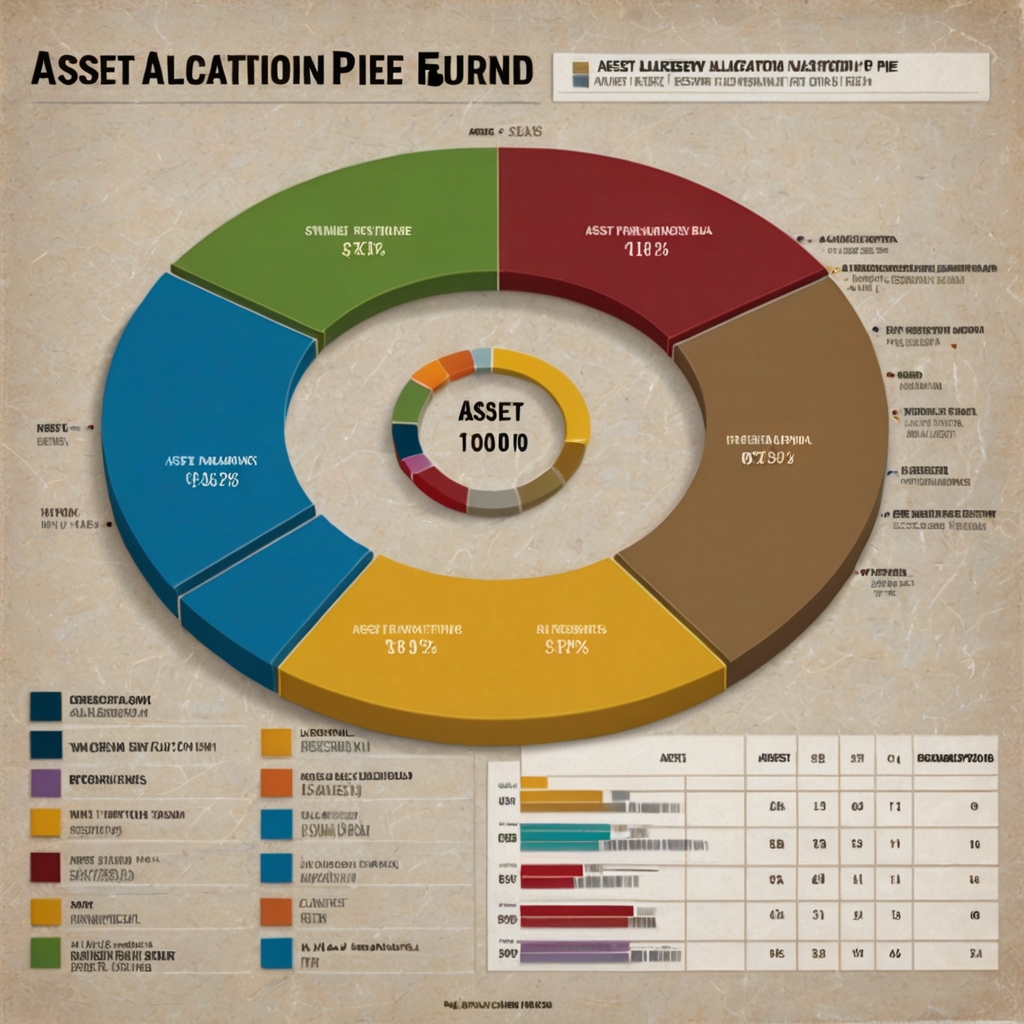

Asset allocation funds are a popular investment option for investors seeking a diversified portfolio without the hassle of managing multiple assets. These funds automatically allocate your investments across different asset classes—such as stocks, bonds, and cash—based on a predetermined strategy. In this […]

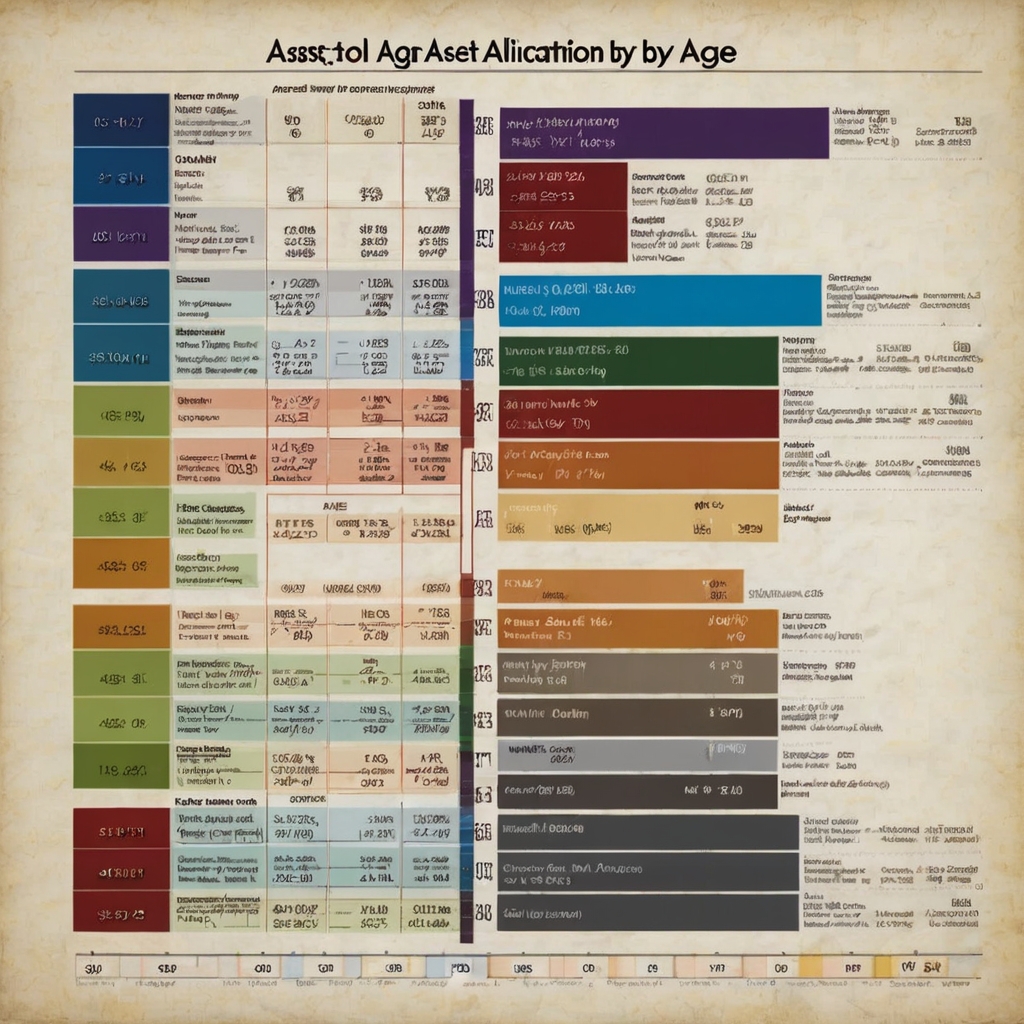

Asset allocation is one of the most critical factors in determining the success of your investment portfolio. As you age, your financial goals, risk tolerance, and time horizon change, requiring adjustments to your asset allocation. Vanguard, one of the world’s leading investment […]

Asset allocation is one of the most critical decisions in investing, as it determines how your portfolio is divided among different asset classes like stocks, bonds, and cash. An asset allocation calculator is a powerful tool that helps you determine the ideal mix of […]

Tactical asset allocation is an active investment strategy that involves adjusting your portfolio’s asset allocation based on short-term market conditions and opportunities. Unlike strategic asset allocation, which focuses on long-term goals, tactical asset allocation allows investors to capitalize on market trends and […]

Strategic asset allocation is a foundational principle of investing that involves dividing your portfolio among different asset classes—such as stocks, bonds, and cash—based on your financial goals, risk tolerance, and investment horizon. Unlike tactical asset allocation, which involves frequent adjustments, strategic asset […]

Cryptocurrencies like Bitcoin and Ethereum have become increasingly popular as alternative investments, offering high growth potential and diversification benefits. However, investing directly in cryptocurrencies can be risky and complex. Enter crypto mutual funds—a more accessible and regulated way to gain exposure to the […]

Investing $100,000 is a significant opportunity to grow your wealth, but it requires a thoughtful and strategic approach. The key to success lies in building a diversified portfolio—a strategy that spreads your investments across various asset classes, sectors, and regions to minimize risk […]