Mahindra Tech, officially known as Tech Mahindra, is a leading global IT services and consulting company. As part of the Mahindra Group, Tech Mahindra has established itself as a major provider of digital transformation, consulting, and business re-engineering services. In this article, we’ll explore the Mahindra Tech stock price, its recent performance, growth drivers, and future outlook.

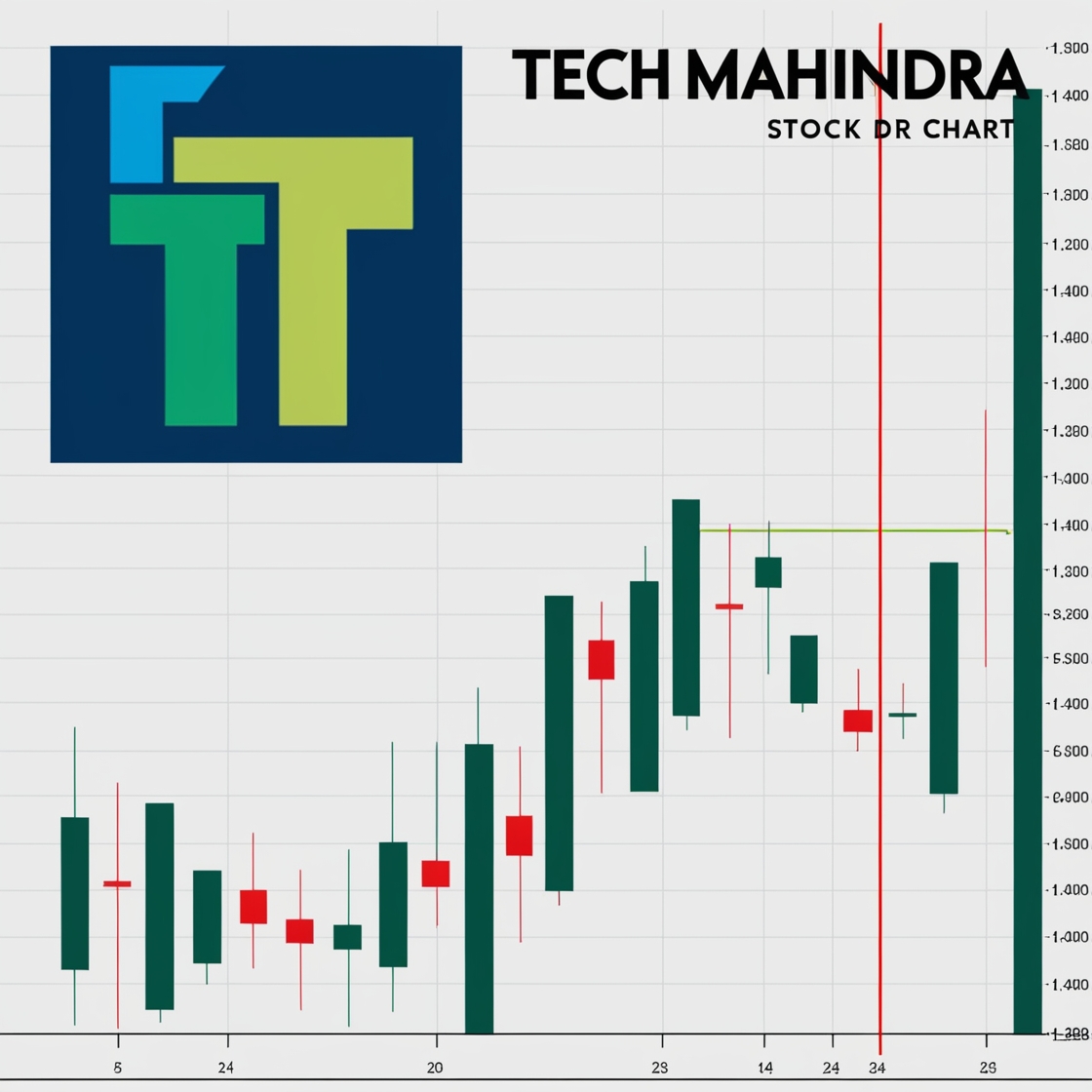

Mahindra Tech Stock Price: Recent Performance

As of [insert latest date], Tech Mahindra’s stock price is [insert current stock price]. The stock has shown [insert performance trend, e.g., “steady growth” or “volatility”] over the past year, influenced by factors such as:

- Global IT Demand: Increased demand for digital transformation services.

- Earnings Reports: Quarterly results and revenue growth.

- Market Sentiment: Broader market trends and investor confidence.

For the latest stock price and performance, visit Tech Mahindra on NSE or Tech Mahindra on BSE.

Key Factors Influencing Mahindra Tech Stock Price

1. Digital Transformation Demand

- Tech Mahindra’s expertise in digital transformation, cloud computing, and AI has positioned it well to capitalize on global IT spending.

- The company’s focus on 5G, cybersecurity, and blockchain technologies is driving growth.

2. Quarterly Earnings and Revenue Growth

- Tech Mahindra’s stock price is heavily influenced by its quarterly earnings reports. Strong revenue growth and profit margins often lead to positive market reactions.

- For detailed financial reports, visit Tech Mahindra Investor Relations.

3. Global Expansion and Acquisitions

- Tech Mahindra has been expanding its global footprint through strategic acquisitions and partnerships.

- Recent acquisitions, such as [insert example], have strengthened its capabilities in key areas.

4. Macroeconomic Factors

- Currency fluctuations, global economic conditions, and geopolitical events can impact Tech Mahindra’s stock price.

- For example, a weak Indian rupee can boost revenues from international markets.

Mahindra Tech Stock Price: Historical Trends

Tech Mahindra’s stock price has shown [insert trend, e.g., “consistent growth” or “volatility”] over the past five years. Key milestones include:

- [Year]: Stock price surged due to strong earnings and increased demand for IT services.

- [Year]: Stock price declined due to global economic uncertainty and reduced IT spending.

For historical stock price data, visit Yahoo Finance – Tech Mahindra.

Future Outlook for Mahindra Tech Stock

1. Growth Drivers

- 5G Technology: Tech Mahindra’s focus on 5G solutions is expected to drive future growth.

- AI and Automation: Investments in AI and automation will enhance operational efficiency and profitability.

- Cybersecurity: Increasing demand for cybersecurity solutions presents a significant growth opportunity.

2. Challenges

- Competition: Intense competition from other IT giants like TCS, Infosys, and Wipro.

- Economic Uncertainty: Global economic slowdowns or recessions could impact IT spending.

3. Analyst Recommendations

- Analysts have given Tech Mahindra a [insert rating, e.g., “Buy” or “Hold”] rating, with a target price of [insert target price].

- For the latest analyst recommendations, visit Moneycontrol – Tech Mahindra.

How to Invest in Mahindra Tech Stock

If you’re considering investing in Tech Mahindra, here are some tips:

- Research: Analyze the company’s financials, growth prospects, and competitive position.

- Diversify: Avoid putting all your money into one stock. Consider diversifying across sectors.

- Monitor: Keep an eye on quarterly earnings, market trends, and global economic conditions.

- Consult a Financial Advisor: Seek professional advice to align your investments with your financial goals.

Conclusion

Tech Mahindra’s stock price reflects its strong position in the IT services sector and its ability to capitalize on emerging technologies. While the stock has shown [insert trend], its future growth will depend on factors like digital transformation demand, global expansion, and macroeconomic conditions. By staying informed and conducting thorough research, investors can make informed decisions about Tech Mahindra stock.

Call to Action:

Ready to explore Tech Mahindra stock? Open a brokerage account today and start investing in one of India’s leading IT companies. For more investment tips, check out our guide on How to Invest in Tech Stocks.

SEO Optimization Tips for This Article:

- Secondary Keywords: “Tech Mahindra stock,” “Tech Mahindra share price,” “Tech Mahindra analysis,” “IT stocks.”

- Readability: Short paragraphs, bullet points, and subheadings for easy scanning.

- Internal Links: Link to related articles (e.g., “How to Invest in Tech Stocks”).

- External Links: Link to authoritative sources (e.g., NSE, BSE, Yahoo Finance).

- Meta Description: Concise and keyword-rich to improve click-through rates.